by Bradley Williams

Inflection points for business owners.

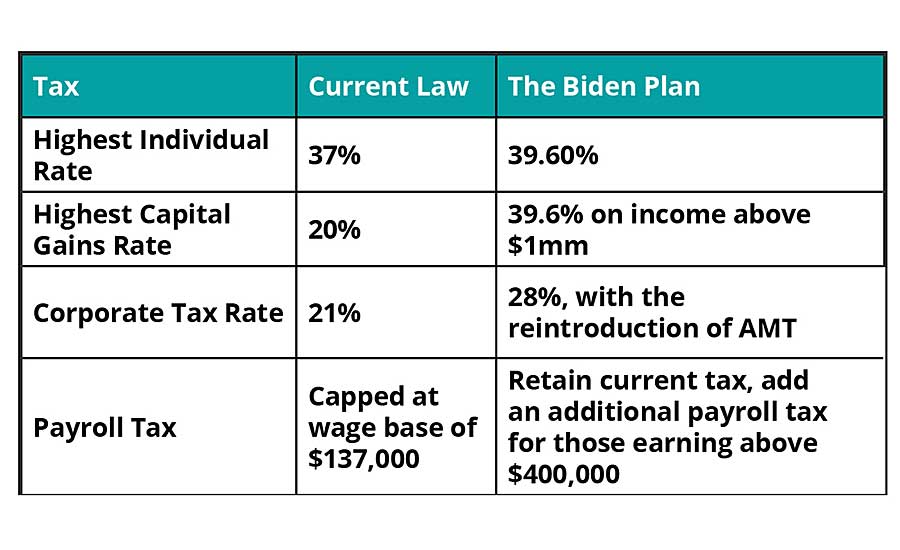

The decision to sell any business involves a complex set of decision-making points. The business’ underlying value, health of the overall industry, interest rates, growth potential, geographical location, owner’s age, taxes and many other factors contribute to an owner’s decision to sell or instead focus on succession planning. Below you will find a few highlights of the proposed plan.

Acceleration of a decision

The impact of the Biden tax plan may accelerate the decision-making process for some businesses wishing to sell while we still are in a lower tax rate environment. With the capital gains tax rate (currently 20%) potentially going to the ordinary rate (39.6% for those with AGI exceeding $1M), this change will seriously affect a seller’s total tax bill. The tax burden would almost double, and in high tax states like California, the bill would be 56.7% (including the state’s capital gains & Medicare taxes). The pundits are saying that the tax bill is next on the list after the infrastructure bill, and could come as soon as this summer or be pushed through this fall during reconciliation.

Potential impacts of the Biden plan on M&A transactions

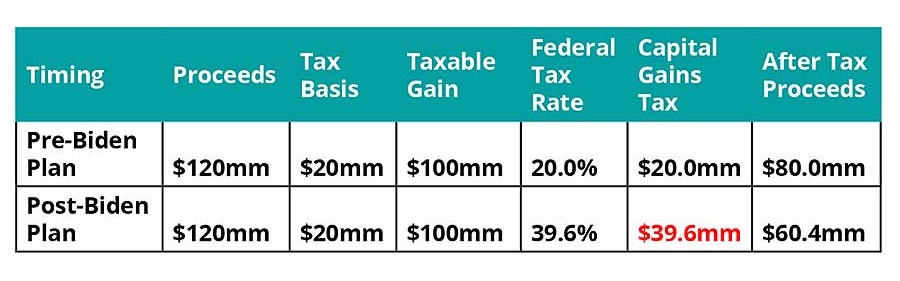

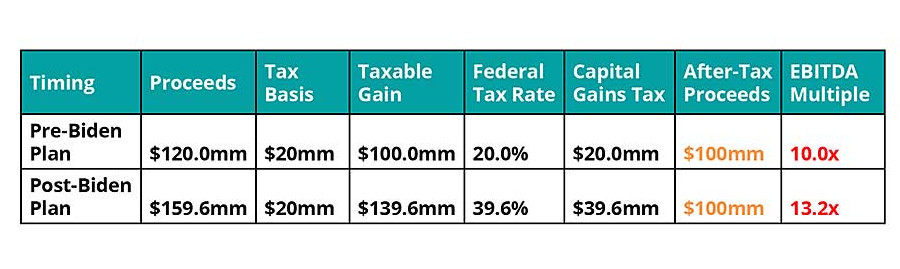

The following scenario will illustrate the net after-tax proceeds if a business is sold before and after Biden’s new tax bill is enacted. Assumptions: A company has $12 million of EBITDA, no state capital gains tax and an exit of 10x multiple with no debt.

A business that was sold at 10x EBITDA in 2020 would have to be sold for 13.2x EBITDA to realize the same net after tax proceeds if Biden’s tax plan passes. This means the business owner would need to sell their business for approximately 33% more than before the Biden tax plan.

Final Considerations

Owners considering the sale of their businesses within the next five years should analyze the Biden plan very carefully. For many people, selling a business is often the most important transaction of their lives. Their decision will impact owners, family members, employees and the communities that they serve. Proper pre-sale planning can minimize taxes. Our firm has successfully helped thousands of family businesses strategize for an exit and/or pre-sale planning strategies. When selling your business, the goal is often to receive the highest bid, but we feel that the net after-tax proceeds through pre-sale planning and timing can be even a more important consideration.

Bradley Williams has 15 years of experience in the investment banking industry. He has structured and executed a wide range of complex transactions, including corporate sales, acquisitions, mergers, inter-family planning options, joint ventures, recapitalizations and leveraged buy-outs. Brad can reached at bwilliams@theberingergroup.com / 717-951-2800 for further comments or questions.

This article was originally published in the Supply House Times, the official publication of the American Supply Association